NEW DELHI. Signaling that the Indian government has shifted its coronavirus strategy from “survival” to “revival” mode, it announced a plethora of measures to not only resurrect the ailing economy but also to insulate it from the deadly impact of the COVID-19 outbreak.

The measures announced by the Finance Ministry on May 13, 2020, may move the GDP graph upward through “ATMA NIRBHAR ABHIYAN”. This is a historical step taken by the Indian government by announcing monetary and fiscal support of Rs. 20 lakh crore Investment scheme for the factors of production (i.e. MSME’s sector).

It also shows the path that how the local product can go globally through vocal policy as introduced by Prime Minister Narendra Modi.

The gist of measures announced under the financial package by the Union Finance Minister Nirmala Sitharaman for inducing liquidity in corporates includes labour law reforms, MSME reforms, and RBI liquidity reforms.

Labour Law Reforms:

The labour law reforms include benefit for under the Pradhan Mantri Garib Kalyan Package (PMGKP), for contribution to the provident fund of employee extended for another 3 months i.e. June, July, and August 2020.

These reforms also aim at providing more take-home salary for employees, statutory PF contribution of both employer and employee reduced to 10% each from the existing 12% each for the next 3 months except for CPSEs and State PSUs and above PMGKP beneficiaries.

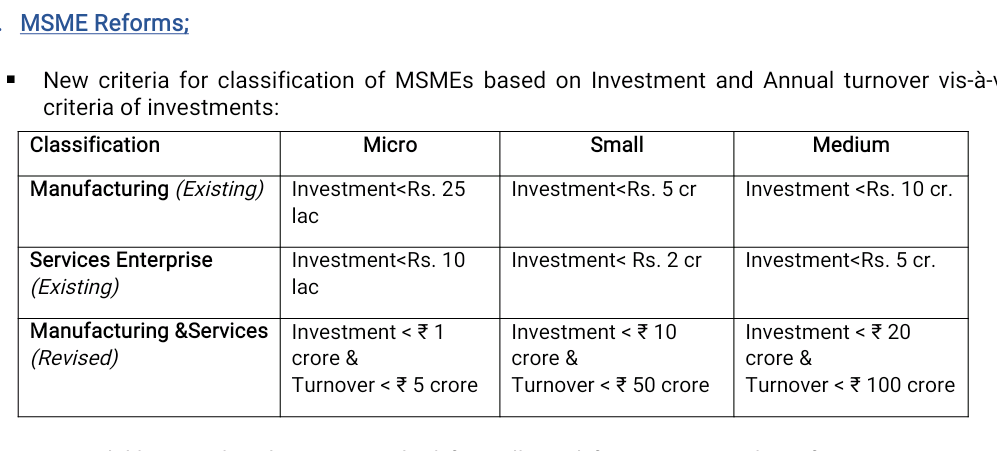

MSME Reforms:

A new criterion for the classification of MSMEs based on Investment and annual turnover vis-à-vis existing criteria of investments have been introduced.

Rs. 3 lakh crore has been earmarked for the collateral-free automatic loan for MSMEs repayable over a period of 4 years and 12 months extended moratorium with capped interest. (Scheme limit till 31.10.2020).

Rs. 3 lakh crore has been earmarked for the collateral-free automatic loan for MSMEs repayable over a period of 4 years and 12 months extended moratorium with capped interest. (Scheme limit till 31.10.2020).

Rs. 50,000 crores will be infused into industries through MSME fund and Rs. 20,000 crores as subordinate debt to Stressed MSMEs by the Indian government

RBI Liquidity Reforms:

Special Liquidity Scheme for NBFC/HFCs/MFIs worth of Rs. 30,000 crores, wherein the investment will be made in both primary and secondary market transactions in investment-grade debt paper, fully guaranteed by GOI.

Partial credit guarantee scheme 2.0 for NBFCs worth of Rs. 45,000 crores, wherein the first 20% of loss will be borne by the Guarantor i.e. the Government of India.

About ShineWing India:

Ranked as one of the emerging top 25 professional firms in India, the ShineWing India is all devoted to creating a global, growth-oriented, professional brand catering to niche clients in India. ShineWing India is a member firm of ShineWing International, a global network of independent accounting and consulting firms, and is currently ranked as the 19th largest accounting network in the world.