India Custom Duty – Troubles and Solutions: Explained at Yokohama India Centre, Japan

Non-tariff barriers, health, sanitary and safety, labeling involving certificate of origin, weight, ingredients, marks, inadequate documentation by exporters, packaging regulation compliances, etc were the issues explained.

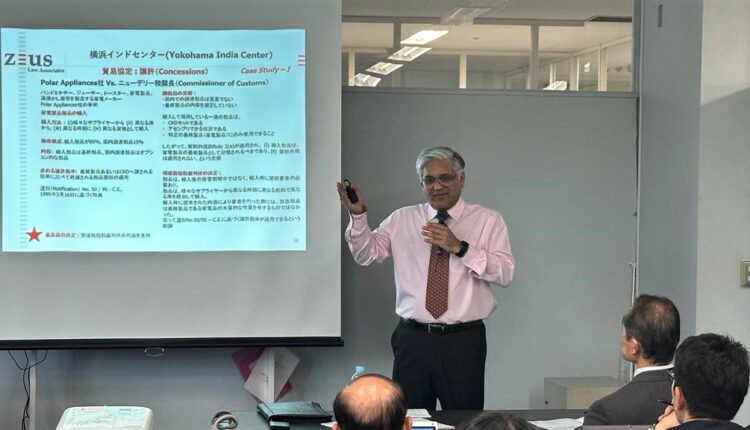

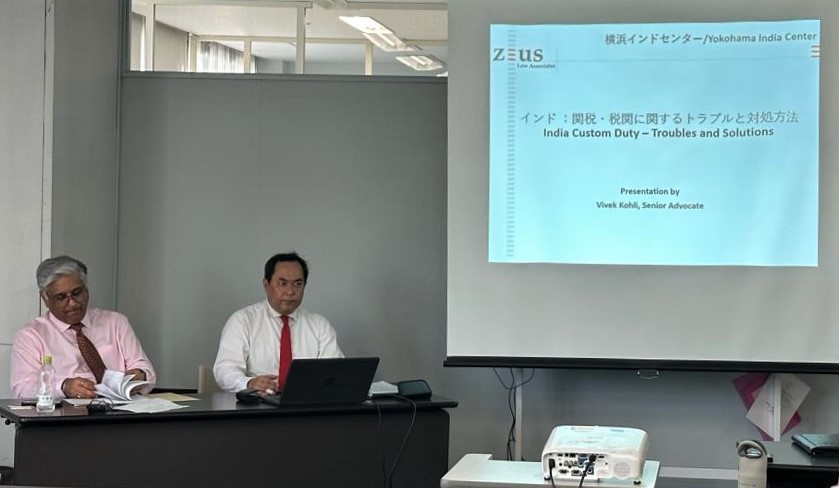

TOKYO: Vivek Kohli, Senior Advocate (former Advocate General for the State of Sikkim), and Sunil Tyagi, Managing Partner at Zeus Law Associates – a full-service corporate & commercial law and litigation advisory firm headquartered in New Delhi, on their recent trip to Tokyo along with Kenji Suzuki San, spoke at a seminar “India Custom Duty – Troubles and Solutions” organized at the Yokohama India Centre.

This interactive seminar was well attended by participants from diverse business sectors. Mr. Kohli explained India’s custom duty regime, and also addressed the concerns of foreign entities involved in EXIM business with India

The session began with Mr. Kohli examining the India-Japan Bilateral trade through the years from 2017 – 2022, India’s trade deficit with Japan, and Japan’s trade surplus with India. He said, “India’s major exports to Japan include mineral fuels, oils and products of distillation, organic chemicals, electrical machinery and equipment, fish and crustaceans, precious metals etc. and India’s major imports from Japan include nuclear reactors and related products, chemical products, electrical and electronic products, machinery and components, iron and steel etc.”

During the presentation Mr. Kohli discussed the common customs-related issues and problems such as the non-tariff barrier, health, sanitary and safety issues, labeling issues involving certificate of origin, weight, ingredients, marks, inadequate documentation provided by exporters, and also the issues related to packaging regulation compliances of the receiving country.

To give the participants more insight into the jurisprudence surrounding customs duty in India, various landmark case-studies such as Polar Appliances, Sony India 2008, Sony India 2017, Okaya Power Limited, and Bullion and Jewelers Association were also discussed.

Related article: Japanese Cos. must conduct multifaceted due diligence before going for Joint Venture in India

For the ease of reference of the participants, towards the end of the presentation, Mr. Kohli also took the participants through the checklist of documents that would be required for customs clearance, both for imports as well as for exports, separately. This proved to be very helpful for the participants so that they could be prepared ahead of time in respect of the information/ documentary requirements for customs clearance.

Mr. Vivek Kohli, Sr. Advocate is a practicing lawyer since 1991. He is a designated Senior Advocate, and served as the Advocate General for the State of Sikkim. His primary practice areas include Constitutional Law, General and Civil Law, all hues of Corporate and Commercial Litigation, Domestic and International Arbitrations, Service Law, Laws of Taxation, Regulatory Practice, Aviation Laws, Real Estate and Property matters, among others.

Mr. Sunil Tyagi, has been a practicing lawyer for over 30 years and is the Managing Partner and Co-founder of ZEUS Law Associates. He leads the Corporate & Commercial Law, Real-Estate & Infrastructure and Compliance divisions. He is well versed in the intricacies of Indian Civil Law, Business and Commercial Law and regularly advises foreign investors as well as Indian entrepreneurs on their business and legal strategy with respect to investment in India.